How does availing Loan moratorium affect my further EMI’s?

Loan Moratorium, is a new term introduced to all in this lockdown. We are getting exposed to new terms, processes and procedures in different walks of life. New is always not good or bad, unless we know the usefulness for us. We at USP FinPro would like to take this as an opportunity and discuss the Loan moratorium facility in detail. In the month of March 2020, RBI declared the moratorium facility. This facility was a blessing for the ones who were facing a cash crunch but there were almost 33% of the borrowers who availed this facility in spite of no real requirement. One out of the three borrowers who opted for the moratorium did so, only to conserve cash at hand. This response was taken by Economic Times from 938 respondents across the country.

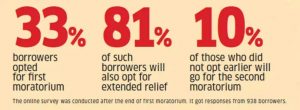

Now that the moratorium date has been extended to 31st August below are the expected statistics of the borrowers who would be opting for the same, according to the Economic Times online survey.

Out of the 33% people who opted for the moratorium, 23% people opted just because of the fear of salary cuts or losing their jobs, which is actually not the situation. The survey also conveys that most of the borrowers have opted for the moratorium for more than 2 loans. Here we need to understand that, moratorium facility is not a waiver but a deferment of the EMI’s and will increase the cost of repayment. The recent loans will have a higher impact on the repayment with the higher tenure, since while calculating the EMI’s the tenure is a very crucial parameter. Hence the moratorium facility should only be availed if it is the only option; else it needs a thorough scrutiny considering the cost of borrowing and the short or longer duration of the borrowing. In such a situation, one should also consider whether the investments should continue or not? If not, which ones to compromise with analyzing the returns expected from the respective investments. We at USP FinPro would be more than happy to help you evaluate the situation best suited to your interest.

Just for an example, if someone took a loan of Rs 50 lakh at 8.5% for 20 years in May 2019, and defers three EMIs, the unpaid interest will compound to add 11 more EMIs to the loan tenure. The total cost of missing three EMIs of Rs 43,391 each will jump to Rs 4.48 lakh. The impact will not be so stark for someone who has completed 10 years of the loan tenure. Those at the nearing the end of the loan tenure will feel a marginal impact. Hence with this example we would like to recommend that, due to lack of no other option, if you choose to moratorium as soon as you are in the position to pay-off the debt clear it immediately say within a year or two from now.

Caringly yours……………