“LOW HEALTH INSURANCE COVER IS EQUIVALENT TO NO HEALTH INSURANCE”

A recent study by IRDAI suggested that only 17% of the total Indian population is covered by health insurance.

A recent study by IRDAI suggested that only 17% of the total Indian population is covered by health insurance.

As humans, we do not like surprises which brings misfortune for us or our family. Medical emergencies is one such misfortune we would never like to experience or if we have to face such a situation we better be prepared for it in advance. This is where the importance of a Mediclaim or Health Insurance comes in.

At USP FinPro we work hand in hand with the client to secure an adequate amount of Health Insurance considering the age of the client, family size and family health history. When it comes to product offering the solutions are always client centric.

It’s an effective and wise way to safeguard your hard earned money from losing it against growing Medical bills, hospital treatments costs for any illnesses, Critical illness or Accidents. It also gives the family the freedom of not compromising with their beloved’s treatment costs.

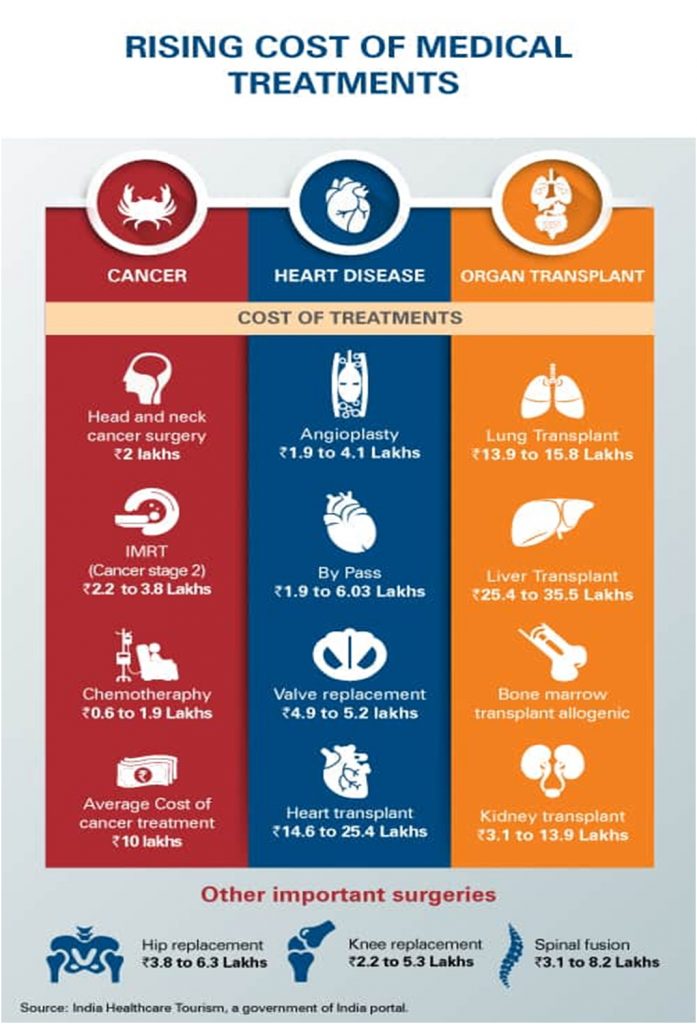

A higher sum insured is always better as there is a constant rise in the cost of medical expenses.

A critical illness can have a huge impact on your life. You may not only have to make major lifestyle changes but also cope with unexpected and often, exorbitant medical expenses. The cost of medical aid is soaring and so are the incidents of critical illnesses, which bring with them mounting costs of hospitalization and medical treatment.

It is, thus, imperative for every individual to be covered with a Critical Illness Insurance policy, because in some cases, these illnesses may lead to the unemployment of a family’s sole earning member. Critical Illness Insurance cover is designed to protect you and your family against the financial burden of such life-threatening illnesses.

Critical Illness Insurance plan provides protection against major life-threatening conditions such as cancer, organ transplant, heart attack and more.

This plan safeguards your financial interests during unfortunate and unforeseeable incidents like accidents.

Life is uncertain; it takes you through twists and turns with accidents that can strike anyone, at any time. Additionally, death or disability of a breadwinner due to an accident can create serious financial problems for your family and you may not be prepared for it. Accidental Insurance is a special insurance plan to save you from such financial stress and to help you in your time of need, anytime and anywhere in the world.

It provides extensive worldwide coverage against death, total permanent disability or partial permanent disability and any other injuries caused due to an accident. This policy also comes in handy against accidents while travelling abroad as it provides a global coverage.

This plan assures financial support and provides a safety cushion for a better tomorrow in case of adverse events like accidental death or disablement including family support benefits like Loss of employment cover, Orphan and Education fund benefits and more.

All of us should buy health insurance and for all members of our family, according to our needs. Buying health insurance protects us from the sudden, unexpected costs of hospitalization (or other covered health events, like critical illnesses) which would otherwise make a major dent into household savings or even lead to indebtedness.Each of us is exposed to various health hazards and a medical emergency can strike anyone of us without any prior warning. Healthcare is increasingly expensive, with technological advances, new procedures and more effective medicines that have also driven up the costs of healthcare. While these high treatment expenses may be beyond the reach of many, taking the security of health insurance is much more affordable.

Age is a major factor that determines the premium, the older you are the premium cost will be higher because you are more prone to illnesses. Previous medical history is another major factor that determines the premium. If no prior medical history exists, premium will automatically be lower. Claim free years can also be a factor in determining the cost of the premium as it might benefit you with certain percentage of discount. This will automatically help you reduce your premium.

You must read the prospectus/ policy and understand what is not covered under it. Generally, pre-existing diseases (read the policy to understand what a pre-existing disease is defined as) are excluded under a Health Insurance policy. Further, the policy would generally exclude certain diseases from the first year of coverage and also impose a waiting period. There would also be certain standard exclusions such as cost of spectacles, contact lenses and hearing aids not being covered, dental treatment/surgery ( unless requiring hospitalization) not being covered, convalescence, general debility, congenital external defects, venereal disease, intentional self-injury, use of intoxicating drugs/alcohol, AIDS, expenses for diagnosis, x-ray or laboratory tests not consistent with the disease requiring hospitalization, treatment relating to pregnancy or child birth including cesarean section, Naturopathy treatment.

Yes. When you get a new policy, generally, there will be a 30 days waiting period starting from the policy inception date, during which period any hospitalization charges will not be payable by the insurance companies. However, this is not applicable to any emergency hospitalization occurring due to an accident. This waiting period will not be applicable for subsequent policies under renewal.

It is a medical condition/disease that existed before you obtained health insurance policy, and it is significant, because the insurance companies do not cover such pre-existing conditions, within 48 months of prior to the 1st policy. It means, pre-existing conditions can be considered for payment after completion of 48 months of continuous insurance cover.

The policy will be renewable provided you pay the premium within 15 days (called as Grace Period) of expiry date. However, coverage would not be available for the period for which no premium is received by the insurance company. The policy will lapse if the premium is not paid within the grace period.

Yes. The Insurance Regulatory and Development Authority (IRDA) has issued a circular making it effective from 1st October, 2011, which directs the insurance companies to allow portability from one insurance company to another and from one plan to another, without making the insured to lose the renewal credits for pre-existing conditions, enjoyed in the previous policy. However, this credit will be limited to the Sum Insured (including Bonus) under previous policy. For details, you may check with the insurance company.

Any number of claims is allowed during the policy period unless there is a specific cap prescribed in any policy. However the sum insured is the maximum limit under the policy.